+1 (408) 418-6717 | [email protected]

MOONLIT CAPITAL

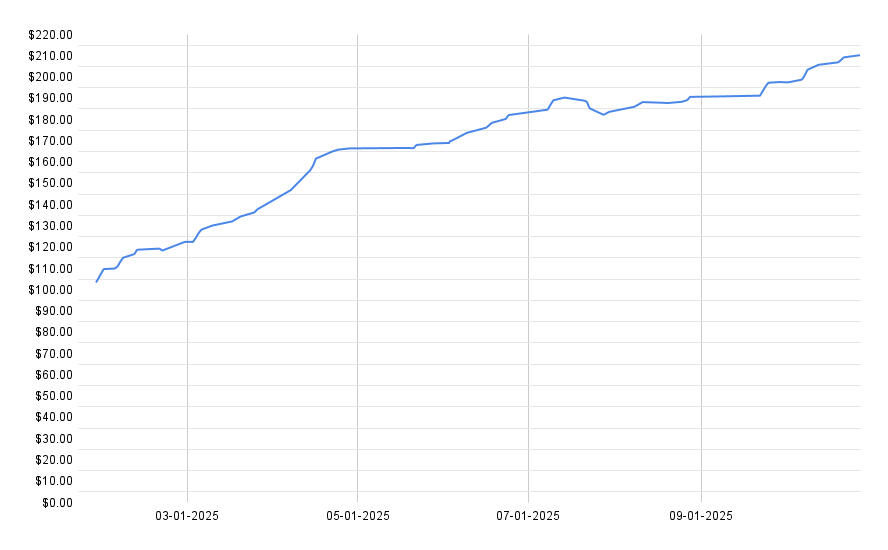

Total Return (Jan–NOV 2025): +110.8%

Raw Sharpe: 6.39 | Win Rate: 81.48% | Max Loss: -4.03%

STRATEGY SUMMARY

Moonlit Capital deploys a high-conviction, technically driven strategy focused on short-term price inefficiencies. Our edge lies in exploiting liquidity grabs and fair value gaps — temporary distortions where market structure misaligns with actual price dynamics. These setups are identified through real-time, rules-based analysis with no discretionary input.The strategy avoids over-diversification and lagging indicators, concentrating capital in a select number of high-quality setups. Designed to perform in both high-volatility and stable regimes, the system is adaptable across timeframes and asset classes.

POSITION SCOPING

We trade across the most liquid equity instruments, including names like AAPL, TSLA, MSFT, and GOOG.While our strategy can operate across any timeframe, we primarily focus on intraday positions held for under 24 hours. This allows us to efficiently extract alpha from short-term volatility while maintaining tight control over risk and exposure.The fund may concentrate up to 100% of capital in high-probability setups, or scale down to 10–20% in more conservative periods.

BACKGROUND

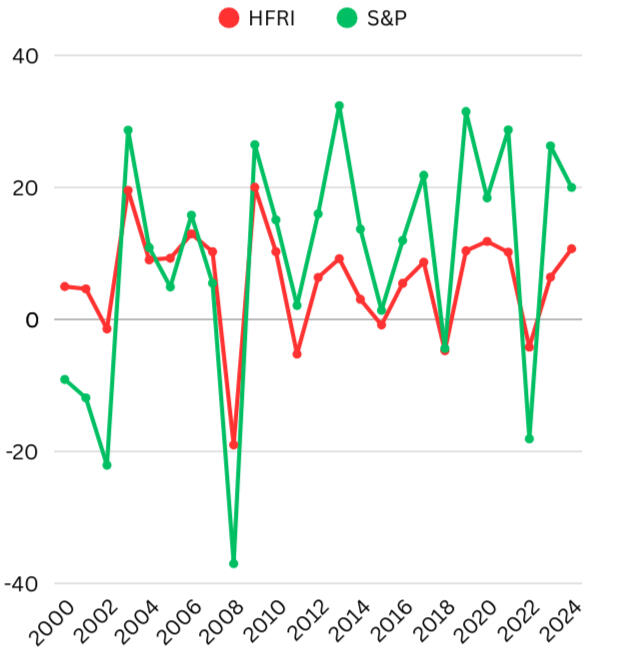

Moonlit Capital is founded and managed out of the Silicon Valley by a team specialized in technical and fundamental analysis based trading.The tested results of the strategies implemented by the Moonlit Capital team have proven to outpreform broader markets during periods of elevated uncertanity as well as periods of great stability, demonstrating consistency, adaptability and discipline.The fund’s foundation is built entirely on market-tested principles — refined through thousands of hours of live observation, algorithmic rule-building, and forward validation.

VISION

We believe most hedge funds have lost their edge — either by becoming too large, too diversified, or too slow to adapt.Moonlit Capital aims to challenge this status quo. Our vision is to run a lean, agile, and focused hedge fund that thrives on volatility, embraces transparency, and puts conviction above complexity.In an industry crowded with noise, we prioritize precision — powered by technical clarity and executed at algorithmic speed.

RISK MANAGEMENT

Capital preservation is at the core of our strategy. Key risk controls include:Strict Stop-Loss Enforcement: Every trade is protected by a hard stop, capping downside.Drawdown Protection: No performance fees are charged until prior high-water marks are surpassed.Dynamic Exposure Scaling: Capital allocation adjusts in real-time based on signal strength and volatility.Macro Event Filters: High-impact news events are excluded from trading windows to avoid avoidable risk.Automation Over Emotion: All entries and exits are system-driven — removing bias and delay.Our approach is not only designed to perform in chaotic environments — it's built to thrive in them.

OUR PERFORMANCE

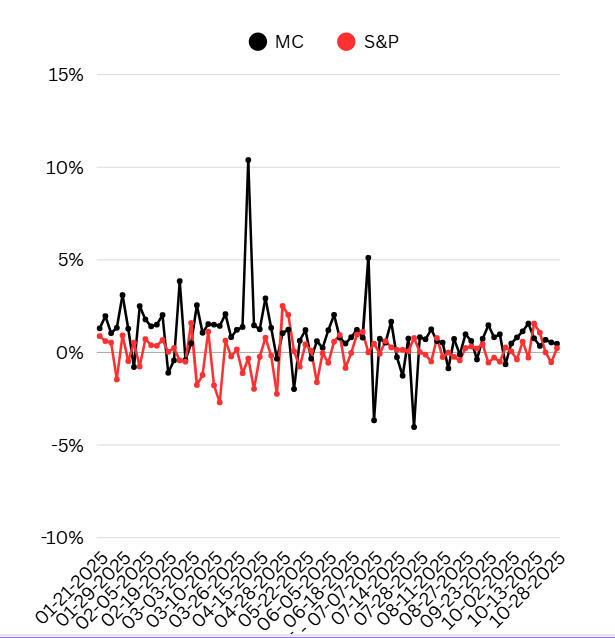

Between January 21 2025 and April 14 2025 we took 82 positions, having a win rate of 81.48% and recording returns of +210.8%. Our highest loss on a trade was -4.03%. Over these trades, our raw Sharpe ratio was 6.39.

CONTACT US

Please include documentation verifying your accredited investor status when requesting access to fund materials.

We look forward to connecting.

+1 (408) 418-6717 | [email protected]

© 2025 Moonlit Capital LP. All Rights Reserved